Svenska kraftnät publishes the schedule for EPAD auctions in Q4, 2023

Since February 2023, Svenska kraftnät offers recurrent auctions of EPAD-contracts in a pilot project. During the fourth quarter of this year, a total of six auctions will be held. During quarter 4, Svenska kraftnät intends to auction annual contracts for 2025, which extends market participants’ hedging horizon in auctions to just over two years.

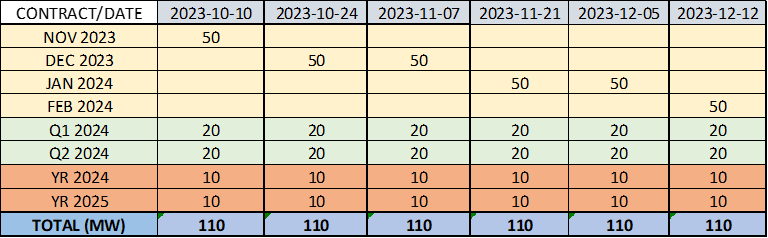

Svenska kraftnät offers recurrent auctions according to previously communicated quarterly auction schedules. An important part of this support to the financial market is to run the auctions and related activities in a transparent and predictable manner. A total of 660 MW will be auctioned on six occasions during the fourth quarter of this year. By auctioning relatively small volumes at multiple occasions, Svenska Kraftnät can offer market participants continuous access to hedging.

Summary – auction days, contracts and volumes – quarter 4 2023 (SE3-SE4, SE4-SE3, SE2-SE3, SE3-SE2).

Link to SKMs webpage (.php) Download

Link to auction schedule (.pdf) Opens in a new window

The primary purpose of the auctions is to contribute to improved price hedging opportunities for market participants, so-called market support, which means arrangements that are made to increase liquidity and reduce uncertainty in the electricity market. The auctions add volumes, support price formation and to some extent adjust for an underlying market asymmetry.

Svenska kraftnät has conducted auctions regularly since February 2023. In June 2023, EEX and Nasdaq announced that they had reached an agreement that EEX will buy the European power and clearing part of Nasdaq. The transaction has entail uncertainty regarding the future of the Nordic forward market model; if the transaction is approved EPADs will be decommissioned from the product portfolio according to EEX. The understanding of Svenska kraftnät, after a dialogue with market participants, is that the market’s view on the pilot remains positive, and that the interest to trade EPADs, at least in the shorter time frame, is not changed regardless of the intentions expressed by EEX. The auctions in quarter four will therefore be conducted as planned.

Using another standardized product that supports hedging of area differences would be possible. Svenska kraftnät’s understanding is that the process for the auctions and the trading rules should be able to convert into the zonal futures EEX plans to introduce instead of EPADs. How we proceed after that is subject to further analysis, where e.g. market participants' continued interest in the auctions constitutes an important input.

Svenska kraftnät is the first transmission system operator in the world to test EPAD auctions to make additional price hedging opportunities available to market participants. Most other transmission system operators in Europe issue so-called long-term transmission rights (LTTRs) with different maturities of up to one year, where market participants purchase future capacity for a specific bidding zone border. LTTRs are normally a complementary hedging product in the sense that they are combined with forwards and futures traded on financial electricity markets. A disadvantage of this arrangement is that market participants, although they can trade e.g. futures several years in advance, cannot supplement them with LTTRs as these are only auctioned one year and one month ahead respectively, and often just before delivery begins. Auctioning of EPADs is based on established hedging products that the Nordic market participants already use for hedging purposes. EPAD auctions are therefore, according to Svenska kraftnät, a more adequate way to support continuous hedging and trading through improved hedging possibilities.

For the first time, yearly contracts for 2025 will be offered in the auctions during the fourth quarter current year. This prolongs the hedging horizon in auctions to more than two years.

In the financial electricity market, a distinction is often made between the timeframe of up to about 3 years before delivery and the timeframe beyond 3 years. Typically, the timeframe up to 3 years is considered to be dominated by the demand for hedging driven by electricity consumption and generation. Beyond 3 years, consumers' and producers' interest in price hedging decreases, it is instead primarily power generation investment decisions that are in focus. The fact that Svenska kraftnät auctions annual contracts for 2025 during Q4 2023 and thus extends the timeframe to just over two years is also in line with the new proposals and recommendations regarding price hedging that have recently been published at EU level.

Read more: