Svenska kraftnät publishes the schedule for EPAD auctions for Q3

Since February 2023, Svenska kraftnät conducts regular auctions of EPAD contracts as a pilot project. During quarter 3, the proportion of quarterly contracts is weighted up slightly in relation to monthly contracts. Furthermore, during quarter 4, Svenska kraftnät intends to auction annual contracts for 2025, which extends market participants’ hedging horizon to just over two years.

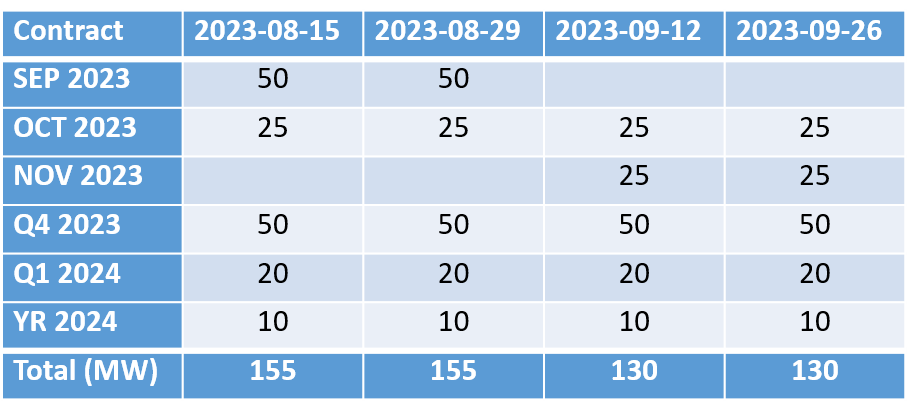

Svenska kraftnät offers recurring auctions according to prearranged quarterly auction schedules. An important part of this support to the financial electricity market is to act transparently and predictably. In total, 570MW will be auctioned on four occasions during Q3. By auctioning smaller volumes on many occasions, Svenska kraftnät can offer market participants continuous access to price hedging.

Summary – auction dates, contracts and volumes - Q3 2023 (SE3-SE4, SE4-SE3, SE2-SE3, SE3-SE2).

The primary purpose of the auctions is to contribute to improved price hedging opportunities for market participants, so-called market support, which means arrangements that are made to increase liquidity and reduce uncertainty in the electricity market. The auctions add volumes, support price formation and to some extent adjust for an underlying market asymmetry.

- Since February 2023, Svenska kraftnät has conducted regular auctions. “After a dialogue with market participants, we have decided to take a summer break and then resume the auctions in mid-August," says Stefan Svensson, Electricity Market Analyst, Transmission and Wholesale Markets.

Svenska kraftnät is the first transmission system operator in the world to test EPAD auctions to make price hedging opportunities available to market participants. Most other transmission system operators in Europe issue so-called long-term transmission rights (LTTRs) with different maturities of up to one year, where market participants purchase future capacity for a specific bidding zone border. LTTRs are normally a complementary hedging product in the sense that they are combined with forwards and futures traded on financial electricity markets. A disadvantage of this arrangement is that market participants, although they can trade e.g. futures several years in advance, cannot supplement them with LTTRs as these are only auctioned one year and one month ahead respectively, and often just before delivery begins. Auctioning of EPADs is based on established hedging products that the Nordic market participants already use for price hedging. EPAD auctions are therefore, according to Svenska kraftnät, a more adequate way to support continuous hedging and trading through improved hedging possibilities.

Facts:

In the financial electricity market, a distinction is often made between the time frame up to about 3 years before delivery and the time frame beyond 3 years. Typically, the timeframe up to 3 years is considered to be dominated by the demand for hedging driven by electricity consumption and generation. Beyond 3 years, consumers' and producers' interest in price hedging decreases, it is instead primarily power generation investment decisions that are in focus. The fact that Svenska kraftnät plans to auction annual contracts for 2025 during Q4 2023 and thus extends the time frame to just over two years is also in line with the new proposals and recommendations regarding price hedging that have recently been published at EU level.

Information about the pilot project

Quarterly report (.pdf) Opens in a new window